Investment Thesis

Before investing, building, or selling a company to us, review these materials to determine if Fork is a good fit.

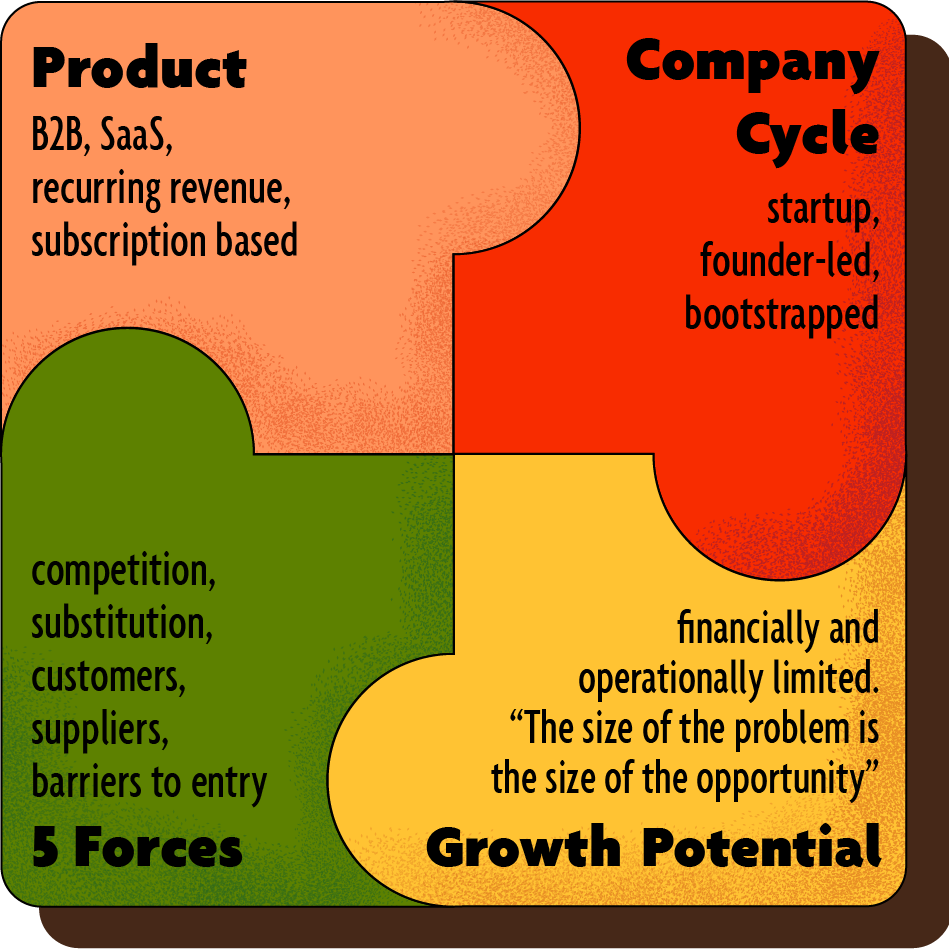

What kind of companies do we buy and operate?

Fork's interests and core competencies are summarized in 4 parts.

Product

Fork has built and maintained projects ranging from ecommerce stores (acq 2019, sold 2020) to niche content sites. Our biggest wins have been B2B SaaS (software as a service). We're not interested in consumer brands, social networks, or mobile applications.

Company Cycle

Founder-led companies operate closest to their original vision. "Startup" implies the total addressable market (TAM) is growing vs shrinking. Bootstrapped founders usually make better decisions than venture-backed founders, as investment = room for mistakes.

5 Forces

We've adopted Porter's Five Forces methodology to measure how our expertise impacts a potential acquisition's formidability. Primarily we target companies that are first to market vs me-too competitors.

Growth Potential

A small SaaS company generating $10-15k MRR presents a challenge for bootstrapped founders. They can a) hire others at the expense of their margin, or b) remain stagnant, making themselves vulnerable to being out-innovated. Hence the essence of our fund: painless exits for founders at a fork in the road.

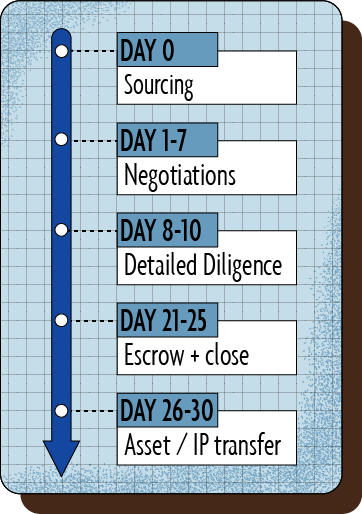

Acquisition timeline

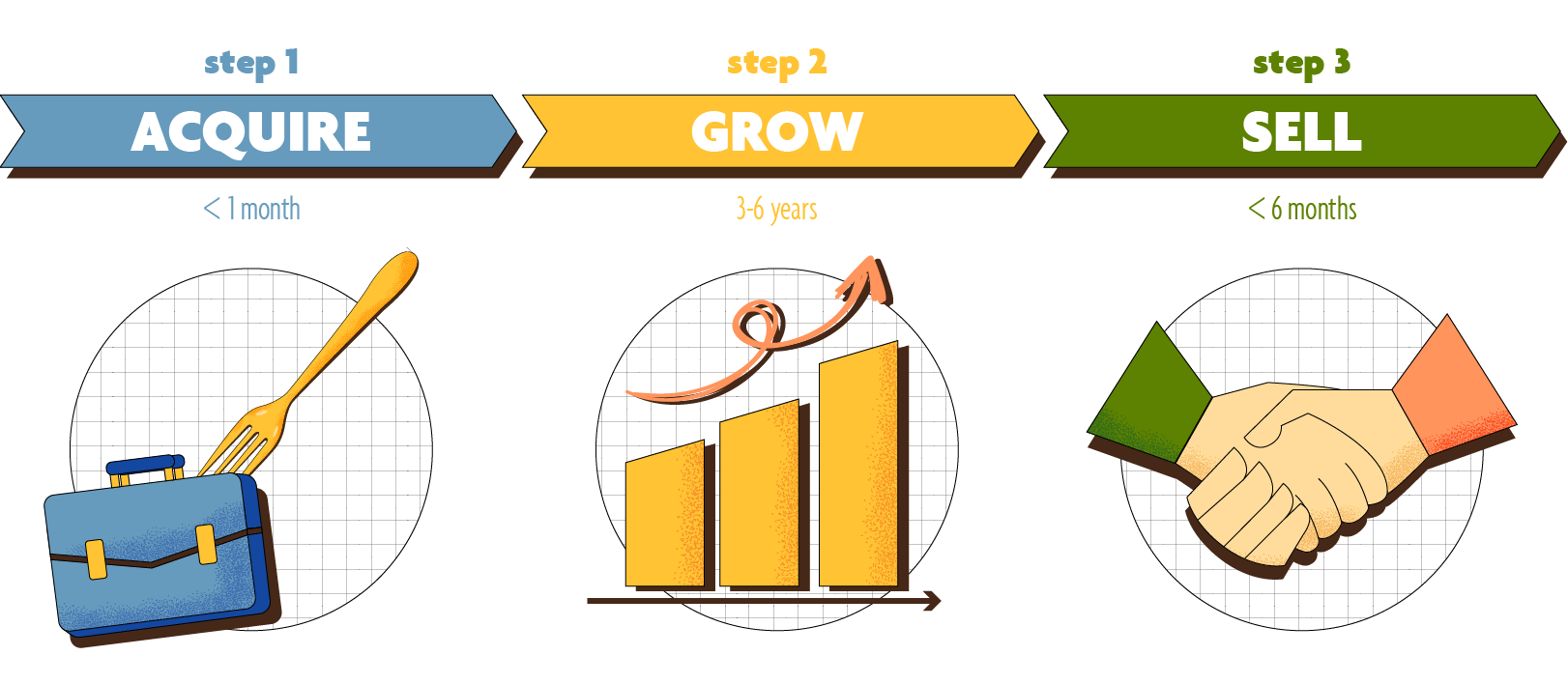

Once we've identified an opportunity that fits our thesis, we move quickly.

There's a saying in finance that "time wounds all deals." For this reason, every acquisition offer we've extended to a founder was made within 30 days.

In some cases the entire discovery → closed process takes just 15 days.

Our diligence is a qualitative and quantitative procedure:

- Source code walk-through by founder or selling team's developer

- Review of bank statements or similar verifiable revenue records

- Probing questions regarding support, maintenance, and market threats

Following data confirmation, we're eager to execute prior to the LOI's closing date when possible.

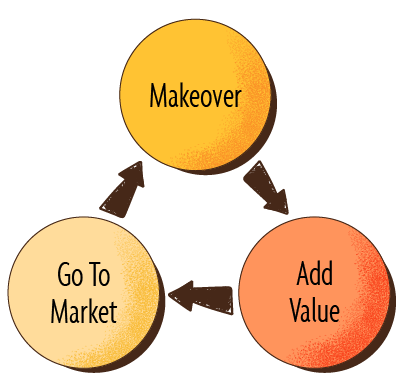

Go to market

Immediately following asset transfer, Fork develops a 3-part strategy:

- Facelift the UI/UX

- Increase pricing

- Go [back] to market

Typically this entails a mix of customer surveys, interviews with the original founder, and a focus on product-led growth.

Our process is described in-depth in our Relaunch and Scale educational materials.

Deal stages overview

"Deals are unique, but the path to product-market-fit is not." Working together with stakeholders, the middle Grow period may last as little as a few months, to upwards of 6 years.

For investors who can't wait that long, in at least two cases we've bought out shareholders (at positive ROI) prior to a formal exit. It's the right thing to do.

Operational strategy

Unlike funds whose managers have never operated or started a business, Fork's team is composed entirely of practitioners. Instead of a 2% management fee, Fork partners are paid alongside investors.

| Comparison Factor | Traditional Fund | Fork Equity |

|---|---|---|

| Management Fee | 2% annual of committed capital | None |

| Process Dynamics | Bloated auction with 3rd party experts, lawyers, investment bankers, parent entities | Friendly founder-to-founder transaction |

| Portfolio Management | Minimal involvement, quarterly board meetings | Fork team = full time operators |

| Transaction Speed | 5+ months of diligence, negotiations, auction, etc. | < 30 days from sourcing to close |

| Capital Deployment Period | 5-10 years per fund | Capital is raised upfront, undeployed capital is released after 12 months |

| Team Backgrounds | Purely financial (investment banking) | Expertise in starting, growing, and selling SaaS companies |

| Performance Fee | Carried interest of 20-25% | Sweat equity as compensation for full-time Partners (engineering, marketing, sales, financial, product management, and more) |

| Investment Strategy | Investments based on wide range of themes | Invests only in products / end markets / tech stacks where Fork is specialized |

| Management Team | Independent management team for each portfolio company | One lean, centralized cross-functional team |

Investing with Fork is not for everyone, and we prefer it that way.

The ideal Fork LP (limited partner) has operational expertise, previous investment experience in private ventures, and alignment with our thesis described above.

Investors receive monthly newsletters with portfolio P&Ls, deal pipeline updates, and product changelogs.

Fund summary

We (exec team bios) founded Fork Equity in January 2017. Since then we've acquired, sold, or founded more than 20 projects. Our most successful exit was acquired for 13x what we paid for it.

We believe acquisitions are partnerships, and we take them very seriously. Our fund structure gives investors access to passive opportunities, managed by our executive team, with monthly cash dividends.